With the stock market at record levels, technology fever running high, and the US economy outperforming most others around the world, one might think the boom times of the 1990s are making a comeback. But the underlying business conditions companies face today couldn’t be more different.

Many of the forces that drove corporate growth during the ’90s and well into this century — disinflation, low capital costs, deregulation, free trade, labor mobility, and geopolitical stability among them — have reversed course or are in jeopardy.

Rarely has the business environment appeared so promising and so uncertain at the same time. Today’s CEOs don’t have the wind at their back — they are traveling directly into it.

CEO concerns in 2024

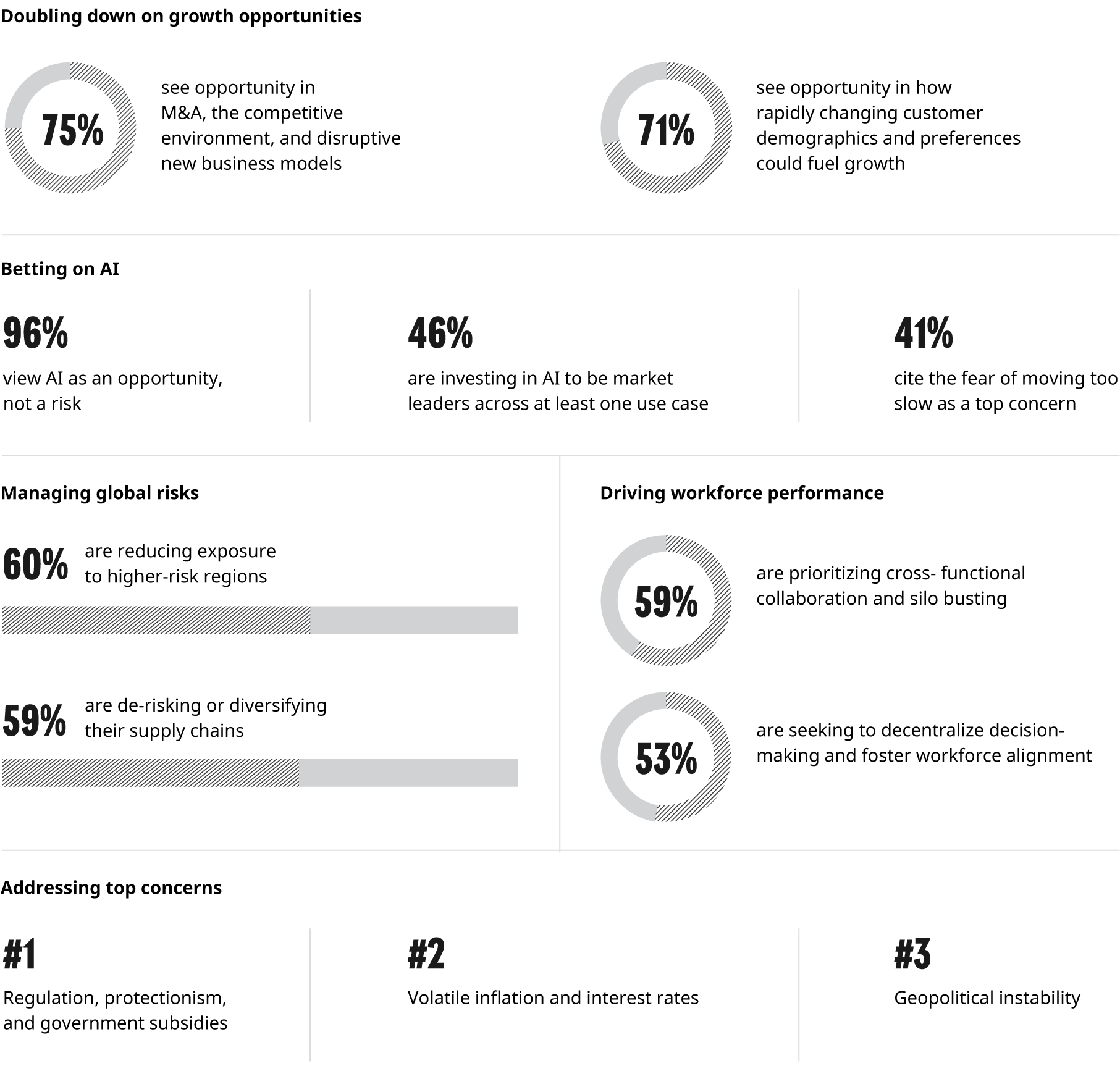

In 2024, the Oliver Wyman Forum partnered with the New York Stock Exchange to assess the attitudes of CEOs of NYSE-listed companies. The biggest concern, shared by 54% of those we surveyed, was the possibility of government interference in the economy via regulation, protectionism, and industrial policy — a sea change after decades of deregulation, free trade, and laissez-faire supremacy. Next up on the list of worries, at 51%: the combination of volatile inflation and higher interest rates. The third biggest concern was geopolitical instability, cited by 37% of chief executives.

To generate “alpha,” or managerial outperformance, in the years ahead, CEOs will need to balance growth and efficiency objectives, revamp supply chains to manage global risks, modernize workforce strategies, and harmonize competing internal and external priorities in an era of technological, demographic, and social tumult.

Diverse food and grocery ecosystems drive growth

The food and grocery ecosystem includes a broad range of company types. The food value chain comprises single-store family-owned businesses and chains of tens of thousands of stores; family-owned single-category suppliers and multinational multi-category CPG conglomerates; as well as a broad spectrum of service providers in technology, logistics, financing, and equipment. The mix of firms is an essential element to what makes the grocery ecosystem work, enabling more innovation in products, in the consumer experience, and in new ways of trade collaboration.

The main priority among the CEOs in our survey was growth. Not every FMI member has the same prioritization. Not every FMI member will pursue growth in the same way. However, every FMI member should understand how some of their major trading partners, customers, and vendors are thinking about growth — and about how growth in the consumer sector might look different than in other industries.

Exhibit 1: By the numbers — what CEOs are seeing and doing

Source: Oliver Wyman Forum x NYSE CEO Survey 2024, Oliver Wyman Forum analysis

CEOs pursue strategic growth amid uncertainty

Many of the CEOs we surveyed are pursuing a new growth agenda tailored for these times. Three-quarters said they see big strategic opportunities on the horizon despite the uncertainty, including mergers and acquisitions and disruptive new business models. And some 71% of CEOs are optimistic about the ways rapidly changing customer demographics and preferences could fuel growth.

But the optimism is tempered. CEOs can’t toggle between “risk on” and “risk off” in an era of higher-for-longer interest rates and rapid innovation — they must drive growth and value simultaneously. That explains why many chief executives cited organic investment in new revenue streams among their top three priorities as cited capital efficiency and cash flow management — 55% in each case.

That said, CEOs are still pushing harder for growth. Twenty-nine percent rated organic investment in new revenue streams as their number one priority, compared with 20% who cited capital efficiency and cash flow management.

Betting on AI to drive growth and value

Artificial intelligence (AI) is the clearest example of the new growth agenda in practice. The overwhelming consensus among CEOs was that AI is the best way to focus on revenue and cost simultaneously.