Although inflationary pressures have eased over the past few months, consumer price sensitivity remains high. In fact, the Federal Reserve’s July Beige Book noted that consumers continue to seek out discounted items or limit their purchases despite moderate price increases. While shoppers have always been interested in attractive prices, their interest in shopping at stores that offer better value for the money is on the rise, according to our most recent Consumer Perception Survey. Retailers delivering on that promise are likely to increase their market share, while those that struggle may see their consumer erosion.

It's critical that retailers adopt new strategies to address this value equation. One effective way to do that is with consumer-centric pricing, which allows retailers to adapt quickly to evolving consumer expectations.

Traditional pricing strategies have limitations

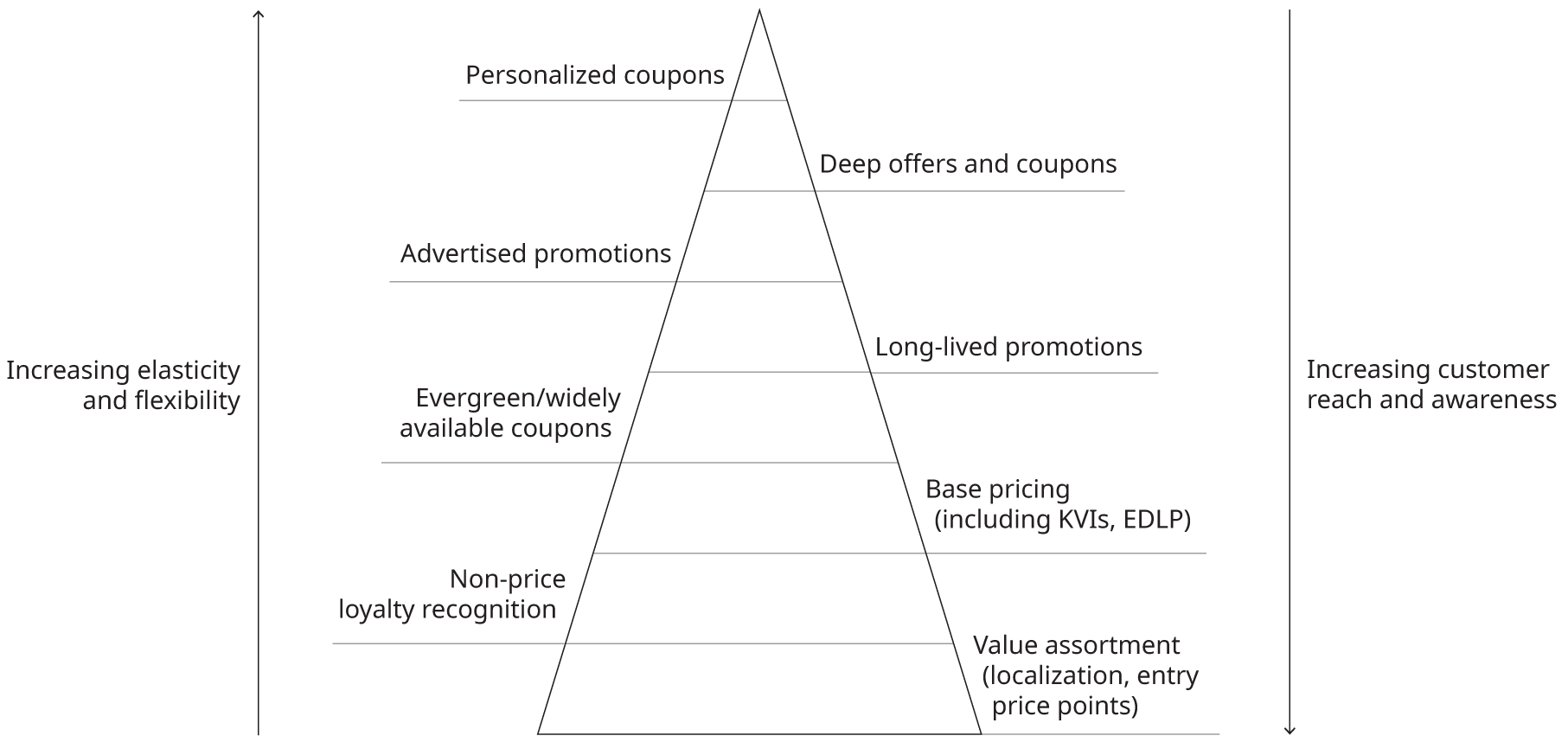

Retailers have several levers to pull when it comes to managing their pricing strategy. Each level of the value stack, as shown in Exhibit 1, differs in its degrees of short-term elasticity and long-term perception impact. A lever such as base pricing has a broad reach as it affects the prices of many items and is visible over time. However, its elasticity is limited since not every customer is interested in the same item, and it cannot be adjusted in the same way for everyone. Personalized coupons provide a higher return on investment per dollar of discount spent but reach fewer customers and do not help drive perception broadly — especially if the customer does not see the offer. Historically, retailers have managed these levels in isolation, without considering how a change in one part of the stack might affect another.

Exhibit 1: Value level 'stack' to drive pricing

Source: Oliver Wyman analysis

Strategies for effective pricing in retail

Maintain an everyday price gap

Follow a reactive base price strategy and, for example, set prices to stay X% above/below a certain reference price of a discount competitor. Depending on the movements of the reference, this approach often requires a significant investment as a price move is executed across a broad set of items, usually without a relative improvement compared to the reference point.