Retail media, currently experiencing rapid growth worldwide, represents the third significant evolution in online advertising. The first wave was driven by search advertising, while the second focused on content and contextual media, including social media. In contrast, the third wave converges on transactions, allowing brands to engage consumers at the point of purchase, revolutionizing digital advertising.

Amazon holds a dominant position in this space, averaging 35% of the global retail media market and up to 75% in the US and Europe. However, other retail media networks are gaining traction and collaborating with brands to deliver unique advertising experiences, indicating a dynamic and competitive landscape.

From just a handful of retail media networks five years ago (including Amazon, Walmart Connect, Target Roundel, Kroger, and Tesco Dunnhumby), the number has now grown to over 200 outside of China, with a total market size of around $90 billion (excluding China).

Brands are increasingly shifting their budgets from traditional advertising to embrace retail media as a means to achieve better targeting and attribution capabilities. Below we highlight key takeaways from discussions with our partners and clients.

How retailers are taking advantage of retail media — on-site, off-site, and in-store advertising

Retailers are seeking to expand their advertising inventory and scale their offerings to attract new advertisers through multiple retail media channels: on-site advertising, such as sponsored products and banners on the retailer's own website; off-site advertising via banners and audience feed augmentation on third-party websites; and in-store solutions like connected screens, scan-and-pay systems, and smart carts. With profit margins estimated to range from about 30% for off-site advertising to about 80% for on-site advertising, retail media offers retailers a significant opportunity to make sizeable profits and rethink their business models.

As they launch their retail media networks (RMNs), many retailers partner with third-party AdTech companies like Criteo and CitrusAd to leverage their technology and established advertising networks. However, as retailers mature in their retail media capabilities, they increasingly aspire to own more of their technology stack to improve margins through enhanced efficiency and data- driven decision-making.

Retailers are also aligning their retail media with their retail strategy by advertising private labels, particularly when slots are unoccupied by national brands. This approach allows them to maximize advertising space and enhance brand visibility. Additionally, they are reaching out to non-endemic brands for advertising, particularly at checkout. One retailer, for example, noted success in attracting investments from pet insurance providers targeting pet food buyers.

While the vast majority of inventory is currently on-site (around 86% of the total market) and off-site (around 11% of the total market), in-store advertising is the next frontier. Some retailers in Europe and Australia mentioned that up to 10% of their retail media revenue was coming from in-store and could soon go up to 40%.

In-store environments offer unique advantages for engaging consumers at the point of purchase and benefit from higher traffic than online sites. This shift toward in-store advertising allows brands to develop more effective lower-funnel targeting strategies. By integrating in-store advertising with loyalty program data, retailers can offer advertisers the ability to execute targeted one-to-one marketing, enhancing the effectiveness of their campaigns.

How consumer packaged goods companies are taking advantage of retail media

Most brands we speak to are increasing their retail media budgets. The most active advertisers are consumer packaged goods (CPG) brands, as they typically lack direct-to-consumer capabilities and do not risk cannibalizing their own sales channels. This is less true for other consumer goods categories, such as furniture, electronics, and apparel.

We estimate that CPG companies in Europe allocate, on average, 19% of their advertising spend to retail media, compared with 39% of those in the United States. This figure continues to grow. Given our estimate of total trade spend at $80 billion in Europe and $160 billion in the United States, the potential transfer to retail media — particularly to in-store retail media — could be significant.

Brands are increasingly interested in developing an omnichannel targeting approach that reflects the existing consumer journey, including online purchases, research online, purchase offline (ROPO), and click and collect. This strategy aims to enhance conversion rates and effectively monitor attribution.

Exhibit 1: Retail media ecosystem

Source: Oliver Wyman analysis

Exhibit 2: Best retail media practices for CPG companies

Source: Oliver Wyman analysis

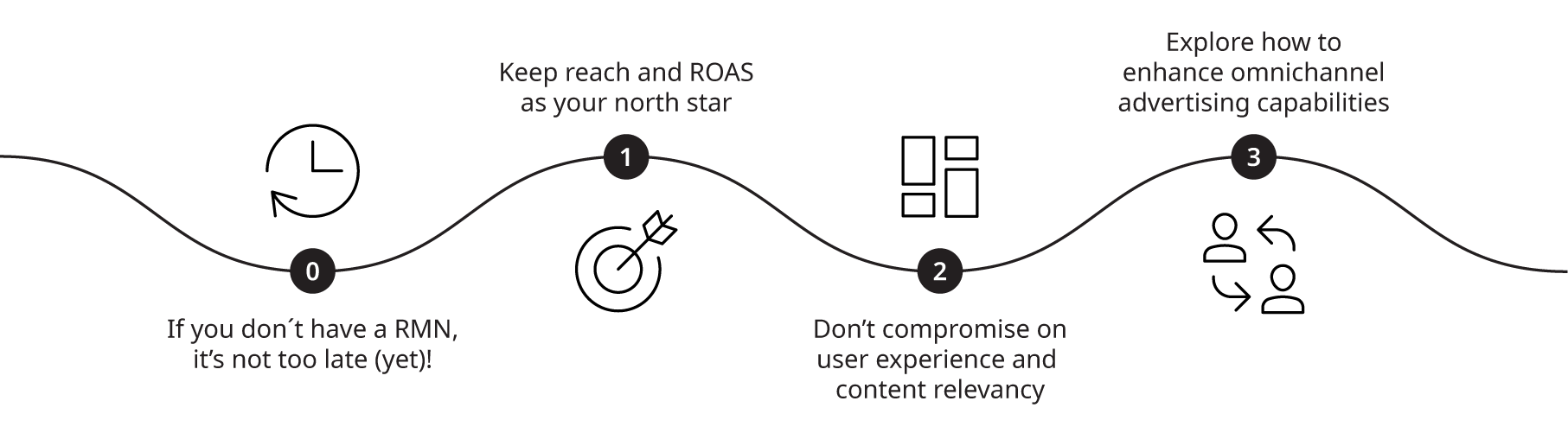

Key strategies for effective retail media implementation

Facilitate cross-functional collaboration and clarify responsibilities

To develop relevant advertising campaigns across channels, it is essential to bring together the customer development, omnichannel/shopper marketing, and marketing/media teams, as each brings a unique perspective. To ensure transparency and control, it is important to clarify the roles and responsibilities of each team and integrate retail media into the broader strategy, including coordinating campaigns with sales and promotional activities.

Explore in-store retail media (sometimes called out of home)

Many brands reported that as retail media becomes more popular, they’ve experienced a visible price inflation for cost-per-click (CPC) and cost-per-thousand impressions (CPM). However, in-store retail media remains nascent and presents brands with the opportunity to innovate. Initially rather manual, multiple in-store players are now working to offer more personalization and programmatic planning capabilities.

Reassess partnerships regularly

As CPG brands seek to expand and develop their retail media strategies across various distribution networks, they find themselves forming partnerships with an increasing number of point solutions (including ad exchanges, ad networks, customer data platforms, data clean rooms, measurement and attribution partners, etc.). While these partnerships can enhance the effectiveness of a brand's marketing efforts, they also introduce layers of complexity to the overall strategy.