The mobile payments market is heading into uncharted territory. That could be good news for card issuers, merchants, and others aiming to grow market share and foster greater consumer loyalty. The seismic change comes from Apple's decision to open near-field communication (NFC) access to third-party application developers.

Apple Pay accounts for approximately 35% of non-cash point-of-sale (POS) transactions in certain advanced markets in Europe, generating €300-€500 million in Apple Pay fees. This strong position is not limited to physical retail environments; Apple Pay has also made significant inroads into e-commerce, allowing consumers to make seamless online purchases. Apple has spearheaded the strong growth of contactless card payments by creating a unique customer experience — paying with a mere double click — and leveraging its position with the consumer to push this as a market standard.

Unlocking iPhone NFC — Apple opens doors for third-party apps

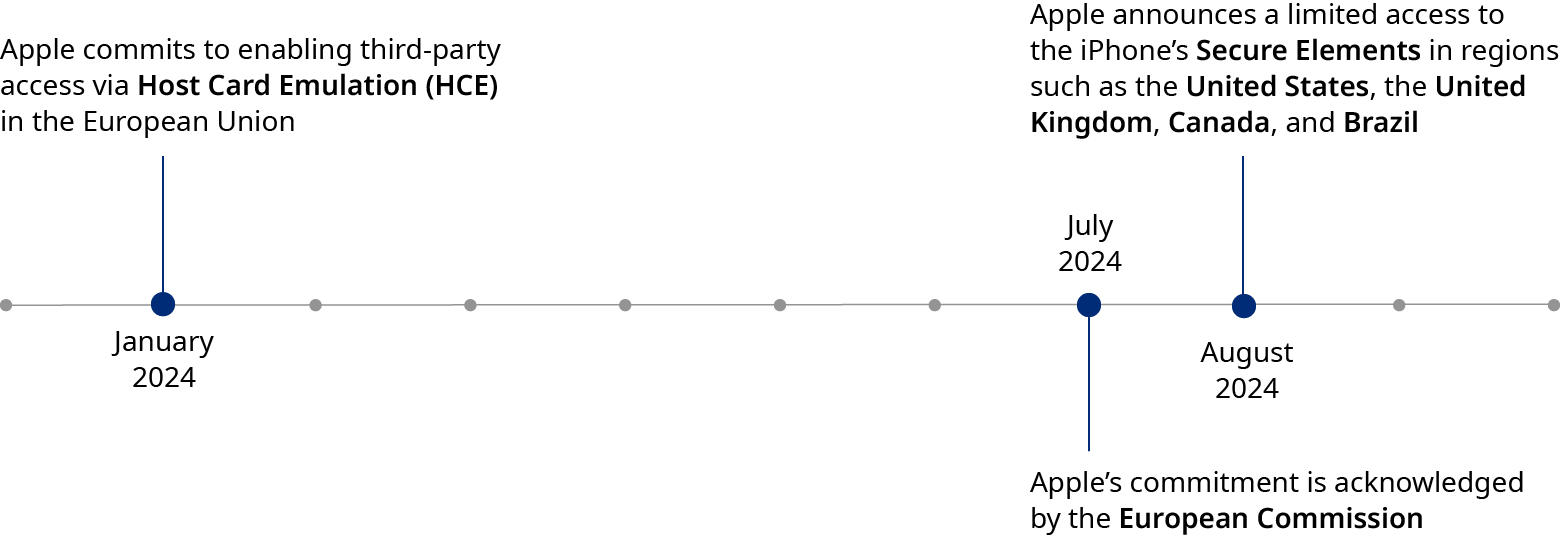

Apple Pay has maintained a significant advantage by being the sole application able to access the iPhone's NFC technology, thereby maintaining a competitive edge on contactless payments at POS terminals. But in reaction to and anticipation of regulatory action by the European Commission, Apple announced in August 2024 plans to enable third-party access via Host Card Emulation (HCE) in the European Union, mirroring the setup currently available on Android devices. In parallel, outside of the EU, Apple started to open access to the NEF antenna in a few selected countries including Australia, Brazil, Canada, Japan, New Zealand, the UK, and the US.

How Apple’s NFC access will transform the payment value chain

Apple’s NFC access policy will have significant implications across the payment value chain, affecting issuers, acquirers, schemes/wallets, and merchants.

Issuers save on Apple Pay fees but face onboarding hurdles

The ability to initiate payments directly through bank applications presents issuers with the opportunity to save on Apple Pay fees and remain the interface of choice for customers. However, customers’ experience around onboarding and paying with different cards (including from different issuers) will remain a challenge. Banks will need to incentivize customers to set their bank app as a default payment app to ensure a seamless user experience.

NFC access spurs proprietary tap-to-pay solutions for acquirers

The opening of NFC access creates opportunities for acquirers to develop proprietary tap-to-pay solutions, effectively avoiding fees imposed by Apple. A critical question arises regarding who will lead this development: Acquirers or Integrated Software Providers (ISV) like electronic cash register (ECR) software solutions?

Visa, Mastercard, and wallets may see more use but face a shift

For incumbent players like Visa and Mastercard, these developments could further accelerate the usage of cards but could also trigger a move from card rails to account-to-account rails as issuers route transactions through their own apps or wallets.

Wallet solutions can use access to NFC chips to gain POS penetration using existing infrastructure. Vipps Mobilepay in Denmark has already made use of this opportunity.

Merchants gain broader payment options with NFC chip access

For merchants, this opens up a broader set of acceptance use cases. Larger merchants can now access the NFC chip to enable payments through their own loyalty and payment apps.

Unique opportunities for European institutions in mobile payments

The recent developments in Apple’s NFC access policy represent a unique opportunity for European institutions to capitalize on the evolving payments landscape. Unlike other regions of the world, European markets are witnessing a commitment from Apple that could reshape the mobile payments ecosystem. This is a pivotal moment for European institutions to position themselves strategically and take advantage of the opportunities presented by Apple's new policies, ensuring they remain at the forefront of the digital payments revolution.