As we enter 2025, the global aviation industry is flying high — setting records in passenger numbers and global revenue. But while air traffic has finally escaped the lingering effects of the COVID–19 pandemic, the aerospace industry faces challenges — and has since 2019 — to increase aircraft production sufficiently to fulfill that demand.

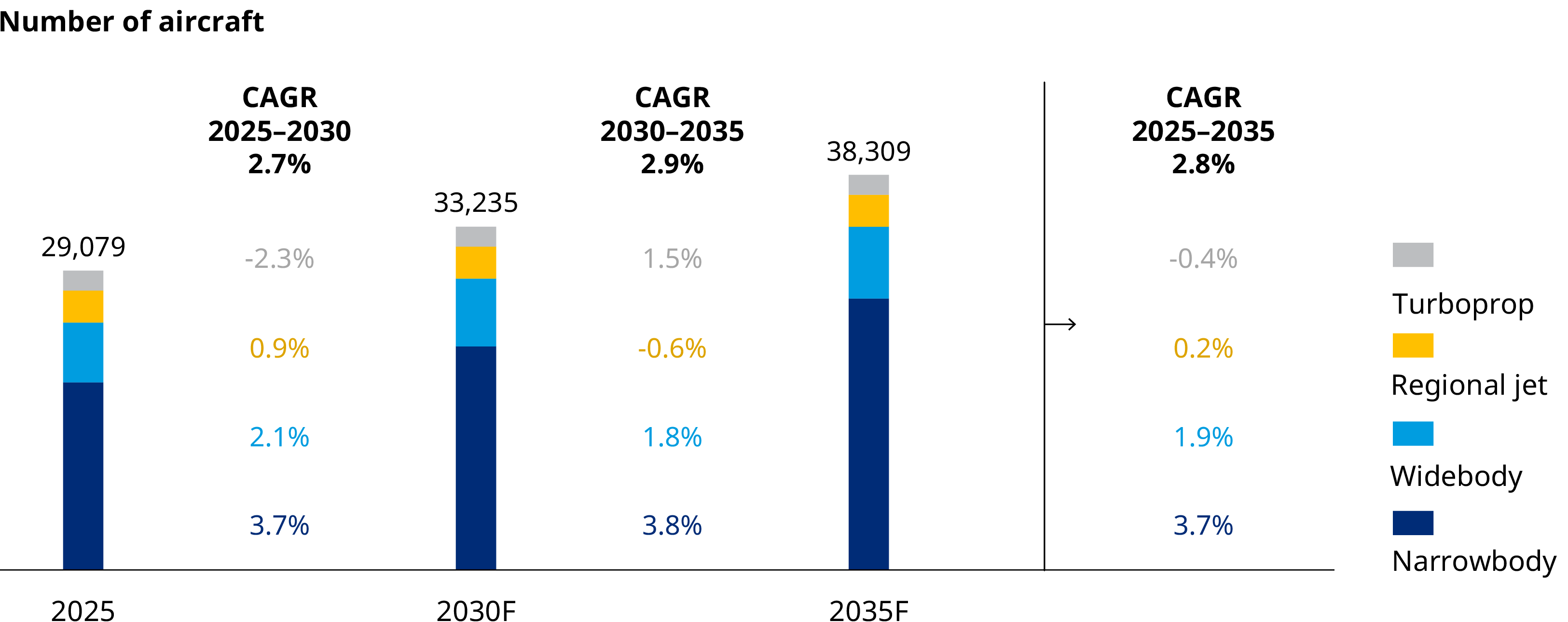

This year’s Global Fleet And MRO Market Forecast 2025-2035 shows the fleet of commercial airliners expanding significantly over the next decade, beginning in 2025 with just over 29,000 aircraft worldwide and building to 38,300 by the start of 2035. That’s a 32% increase, or a compound annual growth (CAGR) rate of 2.8%.

While that’s a respectable growth rate, the 2035 fleet is still expected to fall well short of the 39,000-aircraft fleet we predicted for 2030, in the last forecast issued before the declaration of the pandemic in March 2020. That equates to six years of growth lost to COVID.

How supply chain challenges in aerospace are impacting the aviation sector

Every year since 2018 when the sector set a production record, aerospace has fallen short of not only its all-time high but also of manufacturing enough aircraft to satisfy an expanding aviation sector. Where in 2018 it produced over 1,800 aircraft, the sector only rolled out fewer than 1,300 aircraft by the end of 2024 — 30% less than it had six years before — at a time when aviation is breaking records on travel.

The number of passengers hit an all-time high of 4.9 billion in 2024 and headed to well over five billion this year. Global revenue passenger kilometer (RPK) is up nearly 4% from its peaks in 2019. Yet, today, the backlog of unfilled aircraft orders stands at over 17,000 jets — its highest ever. Given current rates of production, those orders will take 14 years to clear — twice as long as airlines had to wait prior to 2019.

The shortage of aircraft means more airlines must fly older planes, which pushed up the average age of the global fleet by almost a full year in 2024. It also is taking its toll on fuel efficiency, which benefits from the newer jets’ more efficient engine technology. According to the International Air Transport Association (IATA), global fuel efficiency remained unchanged in 2024 — a significant departure from the 1.5% to 2% annual improvement that is typically realized as newer aircraft enter the fleet. This hurts the bottom lines of airlines as well as the battle against climate change.

Supply chain delays and labor and raw material shortages held back production. Issues with manufacturing have also contributed to lower output, starting with the grounding of the 737 MAX in March 2019 after two deadly plane crashes caused by a problem with one of the plane’s systems. Regulatory directives have ordered inspections of thousands of geared turbofan engines and LEAP engines. The checks and servicing are expected to extend into 2027, grounding hundreds of planes at various times over those years. The Federal Aviation Administration has also imposed a monthly production cap on Boeing after a door plug fell off a 737 MAX 9 just after takeoff.

Future trends projected to dominate the aviation industry by 2035

Meanwhile, narrowbody aircraft will continue to dominate the future fleet, with their share increasing from 62% to 68% by 2035. North America will remain the largest market, but emerging regions like China, India, and the Middle East are expected to capture a larger share, highlighting shifting global aviation dynamics.

We project annual production rates to approach nearly 1,300 units in 2025, about 2,200 in 2029, and just above 2,400 by 2035. These projections include flagship models from both manufacturers, such as the Boeing 737 MAX and the Airbus A320neo series, alongside Airbus’ smaller A220 and China’s COMAC C919.

The growth in narrowbodies, as well as Boeing’s production challenges involving the 737 MAX family, have helped make Airbus the world’s largest aircraft manufacturer. The European producer will increase its market share again this year.

Global fleet age increase spurs record MRO market growth

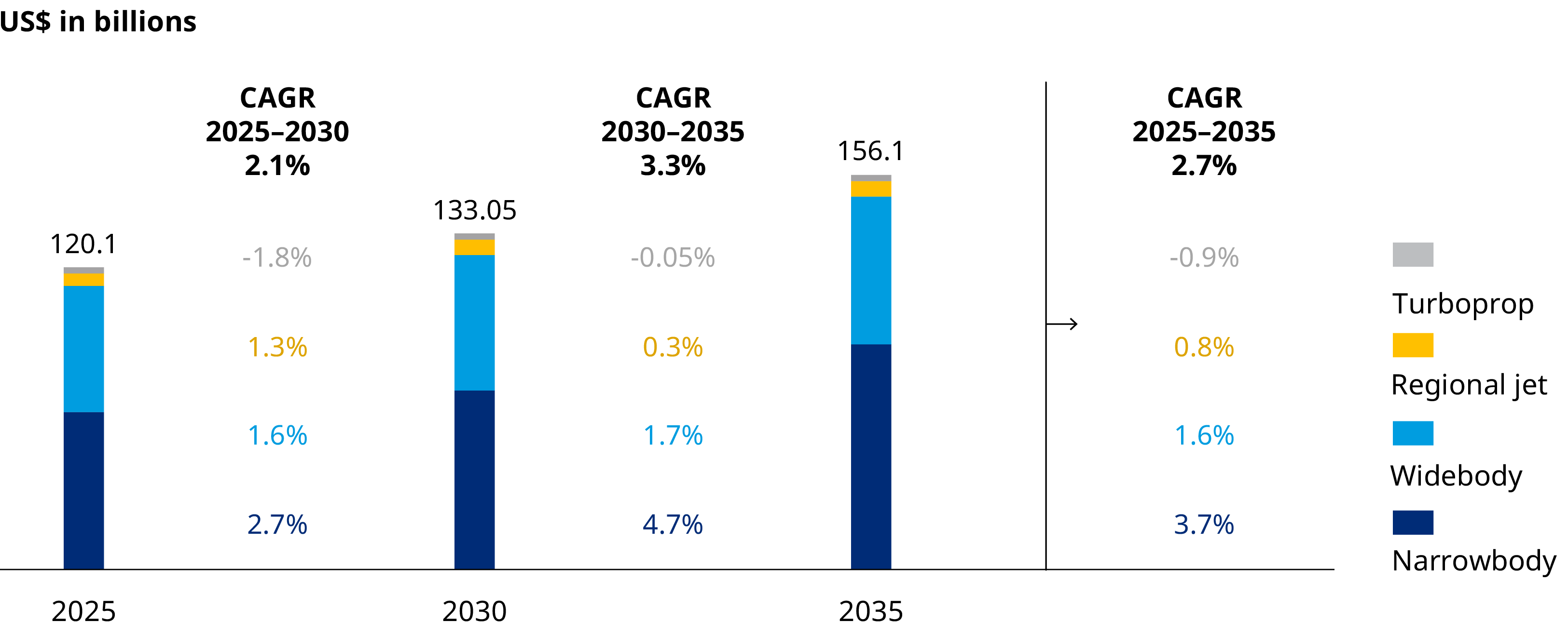

Meanwhile, an aging fleet that requires more servicing is contributing to a super cycle for the maintenance, repair, and overhaul (MRO) market, which is set to reach $119 billion in 2025. That would surpass the previous record high of 2019 by 12%. The average age of the global fleet has risen to 13.4 years, up from 12.1 years in 2024.

The MRO sector is expected to experience a CAGR of 2.7% through 2035, reaching $156 billion by the end of the forecast period. Besides a plethora of older aircraft, this surge in demand is driven by other factors, including unexpected durability issues creating a need for earlier than anticipated maintenance visits. Each aircraft is also putting in more flying hours to help make up for the shortfall in numbers. The increased aircraft utilization is projected to exceed 112 million flight hours annually by 2035. That’s up 39% from 2024.

A global perspective — aerospace sector future trends and challenges

India's rising middle class is fueling airline growth

While Asia, as a region, will see sizable increases in air travel and its fleets, the real star is expected to be India where a burgeoning middle class is ready to spend discretionary income on air travel. To prepare for this onslaught of demand, India’s fleet is expected to double in size by 2035, and more than a dozen new airports are under construction or planned.

China — once the engine behind air travel demand — is projected to grow more slowly over the next few years economically because of an aging population, declines in property values, and shrinking consumption. There is also the potential for trade tensions to disrupt the economy. Still, its fleet is expected to expand 40% over the decade.

North America navigates aging fleet and labor shortage challenges

In North America, while respectable economic growth continues, the aviation market faces challenges such as an aging fleet and labor shortages. Airlines are expected to do their best to retire older aircraft while investing in more fuel-efficient models. The region's MRO demand is projected to grow from $28 billion to $34 billion by 2035, aligned with these fleet modernization efforts.

Europe faces slow growth and low-cost carrier expansion

The Euro area is experiencing slow growth, with many major economies struggling to maintain momentum. However, Eastern Europe is witnessing a rapid expansion in low-cost carrier traffic, driving demand for new aircraft. The region's MRO market is expected to grow at a CAGR of 5.2%, reflecting the increasing need for maintenance as fleets expand.

Middle East sees strong growth amid intense aviation competition

The Middle East's aviation market is benefiting from significant aircraft orders and growing demand for air travel. The region's fleet is projected to grow at an annual rate of 5.1%, with narrowbody aircraft gaining ground. However, profitability remains a concern due to intense competition, particularly from established carriers like Emirates and Qatar Airways.

Emerging markets begins transforming their aviation sectors

Emerging markets, particularly in Africa and Latin America, are beginning to transform their aviation sectors. While Africa's air passenger traffic has rebounded to 108% of pre-pandemic levels, challenges such as political instability and insufficient infrastructure persist. In Latin America, a quicker-than-expected recovery in domestic travel is observed, but the regional jet fleet faces limitations due to pilot shortages and aging aircraft.

Contact Us

Unlock tailored insights for your business. Fill out this form to connect with our team and receive expert guidance on the Global Fleet and MRO Market Forecast.